Securitize’s Path to Going Public: Key Highlights from the Recent S-4 Filing

My "Notes of Note" From Reading the S-4 ($CEPT ➡️ $SECZ)

The latest S-4 filing for the proposed business combination between Securitize and $CEPT (Cantor Equity Partners II, Inc.) was submitted on January 28, 2026, and it’s packed with details about one of the leaders in real-world asset (RWA) tokenization. I’ve pulled the most subscriber-friendly highlights and organized them into a clear, logical flow: the deal background, Securitize’s impressive growth and market position, why tokenization matters, the company’s core strengths, growth plans, platform details, competitive edge, the supportive regulatory environment and lock-up structure. Let’s dive in!

The Deal: How Securitize and CEPT Came Together

Between September 5 and September 17, 2025, the teams exchanged drafts of the Letter of Intent (LOI), negotiated key terms, and locked in the final agreement. Major points included:

An equity value of $1.25 billion for Securitize (plus an earnout based on industry comparables), No warrants or rights attached to SPAC vehicle.

A potential PIPE investment (private placement) with a minimum cash condition.

Lock-up periods for shares received by Securitize stockholders and the SPAC sponsor.

Forfeiture and earnout rules for the sponsor’s founder shares.

Exclusivity and expense provisions.

CEPT 0.00%↑ ticker will become $SECZ

CEPT’s management was ready to proceed if PIPE interest hit at least $150 million—the actual commitments came in stronger at $225 million. This oversubscription shows real investor enthusiasm for Securitize’s prospects.

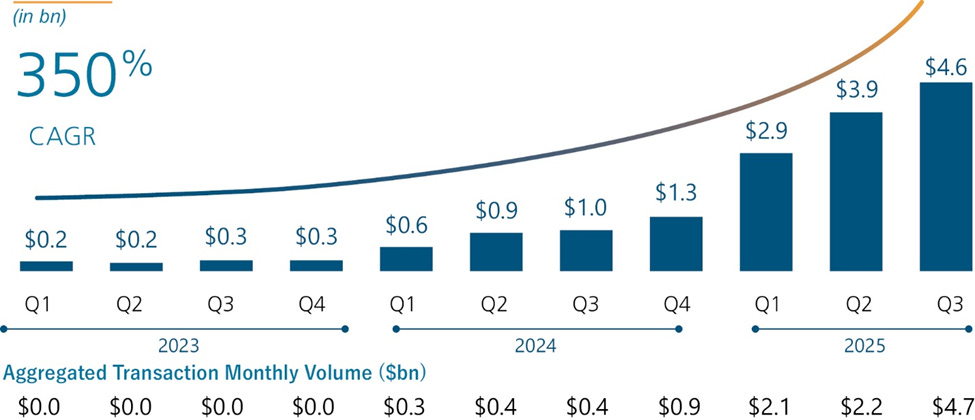

Explosive Growth in Assets and Volume

Since launching, Securitize has scaled massively:

Tokenized assets under management (AUM) jumped from ~$200 million in Q1 2023 to $4.6 billion by Q3 2025—a 350% compound annual growth rate.

Monthly transaction volume (investments, redemptions, dividends, and cross-chain movements) soared from under $50 million to $4.7 billion by Q3 2025.

Market Leadership with Flagship Products

Securitize powers an end-to-end platform across diverse asset classes. Standout examples (as of January 2025):

$1.7 billion in BlackRock’s BUIDL (one of the fastest-growing tokenized treasury funds).

$720 million in Exodus’s tokenized Class A and B common stock (natively tokenized shares of a public company).

$400 million in Blockchain Capital’s VC fund (the largest tokenized institutional fund).

$125 million in Apollo’s Diversified Credit Fund (ACRED—the largest tokenized private credit fund).

Per industry tracker RWA.XYZ, Securitize holds 19.5% overall market share—more than double the next competitors. It also dominates key categories: 33% in tokenized treasuries, 29% in institutional funds, and 31% in tokenized stocks.

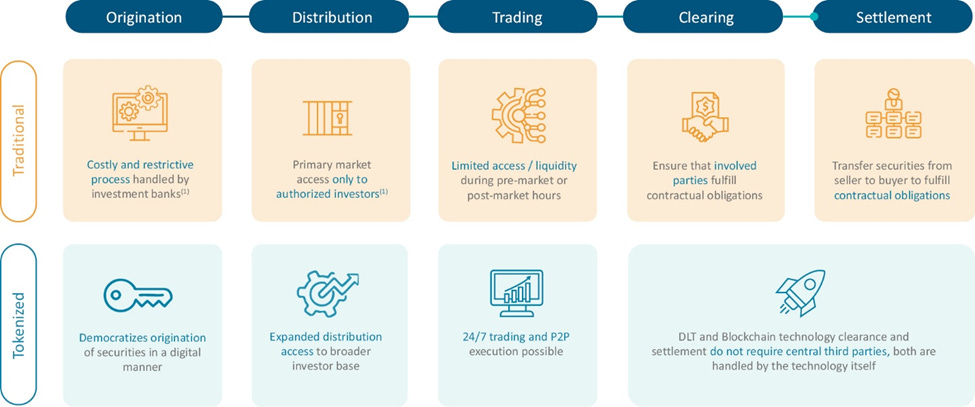

Why Tokenization Changes Everything

Tokenization reshapes traditional finance by making assets more accessible, liquid, transparent, and efficient. It cuts out unnecessary intermediaries and reduces costs, creating a more open and frictionless ecosystem for issuers and investors. Securitize is built to unlock features impossible on legacy rails—like seamless cross-chain transfers and DeFi integrations—while staying fully compliant.

Securitize’s Core Strengths

Trusted by top institutions: Partnerships with Apollo, BlackRock, BNY, Hamilton Lane, KKR, VanEck, and over 15,000 investors. More than $4 billion tokenized so far.

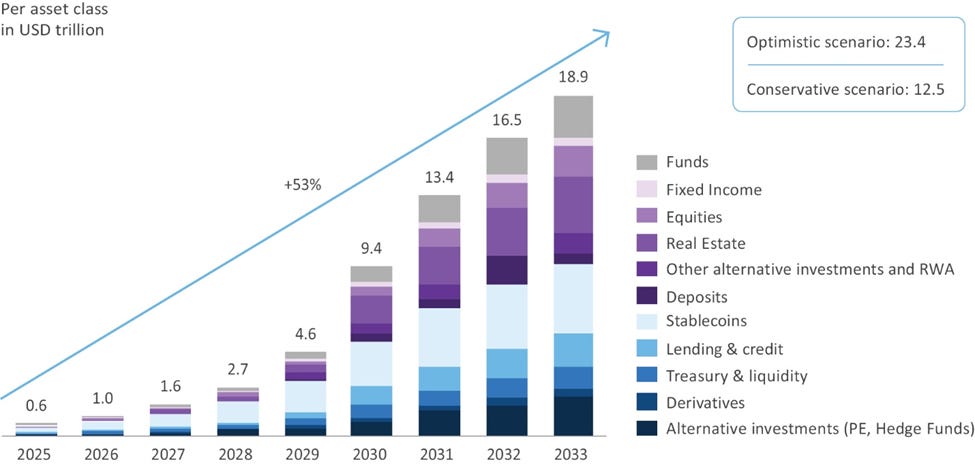

Massive $19 trillion TAM: Perfectly positioned for global regulatory tailwinds in RWA tokenization, with room for the market to grow even larger.

Vertical integration: The only platform handling tokenization, asset servicing, and distribution end-to-end—driving network effects, 500,000+ registered accounts, and industry-leading volume.

Fully regulated stack: SEC-registered transfer agent, broker-dealer, ATS, and fund administrator. Approved as a broker-dealer in 15 EU countries; pending EU DLT Pilot approval.

Deep ecosystem: Supports 18 major blockchains, integrates with DeFi protocols, stablecoins, custodians, and oracles for institutional-grade liquidity and compliance.

Founder-led: CEO Carlos Domingo brings 25+ years of innovation experience from Telefónica and beyond.

Clear Growth Strategy

The Company will be uniquely positioned to capitalize on the global regulatory tailwind to participate in this $19 trillion total addressable market (“TAM”) for tokenization of RWAs and ready to unlock features and utilities not possible on traditional rails. With an increase in adoption and emerging use cases, they believe that the TAM for tokenization could expand even more over the coming decades. These market opportunities represent immense untapped potential for Securitize’s growth.

Estimated Growth in Tokenization Through 2033:

Near-term (next 3 years) – Capture more of the $4 trillion crypto market:

Expand distribution partnerships and launch new funds.

Add DeFi utility, tokenize public equities, and monetize AUM through fund admin, trading, lending, stablecoin conversions, and structured products.

Medium-term (3–5 years) – Expand into the $400+ trillion TradFi market:

Remove barriers (wallets, UI complexity) via integrations with major TradFi platforms.

Focus on three pillars: tokenized treasuries (already leading with BUIDL), yield-generating funds (e.g., CLOs, private credit), and retail public equities (pioneered with Exodus and new FG Nexus framework).

Plan to natively tokenize the post-merger public company itself on listing.

The Platform: End-to-End and Regulated

Tokenization: Native issuance on 18 blockchains (Ethereum, Solana, Polygon, etc.).

Asset servicing: Real-time record-keeping, NAV calculations, dividends, compliance.

Distribution: Regulated primary and secondary trading via broker-dealer and ATS.

DeFi integrations: Enables lending, borrowing, and collateral use while staying compliant.

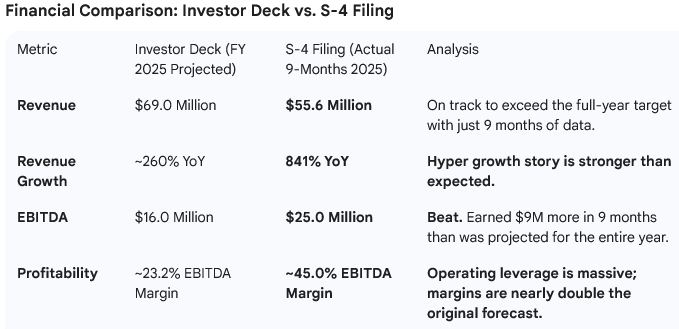

Financial Momentum – The Numbers Tell the Story

The S-4 provides concrete evidence of Securitize’s rapid commercialization. The S-4 filing reveals results that have dramatically outperformed the projections shared in Securitize’s earlier investor presentation deck (the one that accompanied the initial public filing in late 2025, based on data through mid-2025).

Financial Comparison: Investor Deck vs. S-4 Filing

What this actually means In just nine months of 2025, Securitize has already generated $55.6 million in revenue (up 841% YoY) — putting the company on pace to comfortably surpass the full-year $69 million target that was considered aggressive just a few months earlier.

The profitability picture is even more striking. The original investor deck modeled $16 million of Adjusted EBITDA for all of 2025 (~23% margin). In reality, Securitize delivered $25 million of EBITDA in the first nine months alone — $9 million more than the full-year forecast — while achieving ~45% margins, nearly double what was projected.

This outperformance is driven by:

Explosive scaling of high-margin tokenized products (especially BlackRock BUIDL and Apollo ACRED)

The accretive MG Stover acquisition boosting fund administration revenue

Strong operating leverage as fixed costs are spread over rapidly growing AUM and transaction volume

Bottom line: The business is not just hitting earlier targets — it’s smashing through them with better margins and faster growth than management itself was forecasting in the initial deck. This acceleration—driven by blue-chip product launches, acquisitions, and ecosystem integrations validates the $1.25 billion equity value, explains the $225 million PIPE oversubscription, and gives strong confidence in the updated 2026 outlook ($110 million revenue, $32 million EBITDA, ~$9 billion AUM).

Competitive Edge

Fragmented space, but Securitize differentiates vs.:

Other tokenization providers (Centrifuge, INX, Superstate, tZERO): Securitize has superior scale, blue-chip clients, full regulated stack.

In-house asset manager solutions (Franklin Templeton, WisdomTree): Securitize has neutral infrastructure for any issuer.

Wrapper-token issuers (Ondo, Backed): Securitize has stronger compliance and investor protections.

Regulatory Tailwinds

“Regulation first” philosophy has built a robust compliance moat. The U.S. GENIUS Act (July 2025) clarifies stablecoins and tokenized assets, boosting institutional confidence. Parallel progress in EU, Hong Kong, Japan, Singapore, UAE positions Securitize to lead a compliant, scalable RWA ecosystem.

Lock-Up Structure: 90-Day Hard Stop, Tiered Insider vs. Sponsor Triggers

The S-4 outlines a structured lock-up designed to align incentives and prevent a sudden “supply shock” of shares hitting the market. Here’s how the release schedule breaks down (based on my understanding of the S-4):

1. Securitize Rollover Shareholders: Existing insiders and early investors are subject to a 180-day lock-up, including a strict 90-day hard lock during which no shares may be sold (absent a change-of-control event).

After Day 90, shares may be released early in one-third (1/3) increments if performance thresholds are met for 20 out of any 30 trading days:

Tier 1: 1/3 released at ≥ $15.00 VWAP

Tier 2: 1/3 released at ≥ $17.50 VWAP

Tier 3: Final 1/3 released at ≥ $20.00 VWAP

If these hurdles are not achieved, shares remain locked until the full 180-day period expires.

2. CEPT Sponsor (Cantor Affiliate): Sponsor shares follow the same 180-day structure, including a strict 90-day hard lock, but with lower performance thresholds — meaning sponsor shares can unlock at lower price levels than insider shares:

Tier 1: 1/3 at ≥ $12.50 VWAP

Tier 2: 1/3 at ≥ $15.00 VWAP

Tier 3: 1/3 at ≥ $17.50 VWAP

This effectively creates a staggered “supply ladder” beneath the insider thresholds.

3. PIPE Investors ($225M): PIPE investors are not subject to performance-based price triggers. Their liquidity depends on the effectiveness of the resale registration statement. Once declared effective by the SEC (typically ~30–60 days post-close), PIPE holders may sell freely. As a reminder, The $225M PIPE was not just upsized—it was anchored by strategic, crypto-native institutional leaders:

Anchor Names: The round was led by ParaFi Capital, Borderless Capital, Arche, Hanwha Investment & Securities, and InterVest.

The “Long-Term” Signal: These are thematic investors deeply embedded in the RWA ecosystem. Many, such as ParaFi, are not just passive backers but active users of Securitize’s infrastructure.

Why This Favorable Lock-Up Structure Matters for $SECZ: The 90-day hard lock creates an initial supply vacuum. After that, incremental insider selling only occurs if the stock is materially outperforming its $10 listing price. In other words, meaningful insider supply is gated behind strength — not weakness — a structure that can materially influence early trading dynamics, volatility, and potential short-interest setups. Because the PIPE is comprised of strategic, blue-chip institutional partners rather than "fast-money" hedge funds, $SECZ is positioned with a much more stable early float than the typical SPAC.

⚡ The Bottom Line

$1.25 billion valuation + $225 million PIPE, $4.6 billion AUM with 19.5%+ market share, 841% revenue growth in 9M 2025, high-margin profitability already achieved during its growth phase, and a clear path to $110 million revenue / $9 billion AUM by 2026.

Securitize appears to be one of the strongest pure plays on the tokenization megatrend—with regulatory armor, institutional trust, and vertical integration that few can match. Furthermore, its “Lock-Up” structure is built for share price success not immediate supply.

My estimated timeline for the merger to close is late Q1/early Q2 2026.

Paid subscribers received this article earlier this week. Sign up to get early access.

*The first three charts above were sourced from the $CEPT/Securitize S-4.

Disclosures: I have a beneficial long position in the shares CEPT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it and I have no business relationship with any company whose stock is mentioned in this article. My articles are published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. I may sell or buy this security at anytime, before or after this publication.