Securitize, Inc.: Powering The Future Of Tokenized Financial Markets

Why This Tokenization Pure-Play is My Most Exciting Stock To Own for 2026 ($CEPT, $SECZ post merger)

The year 2026 is poised to be the inflection point where Real-World Asset (RWA) tokenization transitions from a theoretical concept to an institutional market utility. At the core of this transition stands Securitize (NASDAQ: CEPT 0.00%↑ now, $SECZ post merger), an infrastructure play positioned to become the market-defining tokenization platform. The investment thesis for Securitize (the “Company”) is rooted in its unique regulatory moat and institutional adoption, setting it up as the essential, low-friction layer for a market projected by the Company to reach $19 trillion in Total Addressable Market (TAM). This isn’t hype—it’s happening, with the tokenized RWA market tripling in 2025 to near $20 billion of distributed value (real third-party demand) across public blockchains, per industry estimates*. Some reports have the RWA market even larger, using differing “market size” definitions, but no matter how you define it, the market is exploding.

⚡ Investment Summary: Key Takeaways

The Catalyst: The tokenized RWA market tripled in 2025; 2026 is the year tokenization becomes a core institutional utility and a huge Wall Street theme for years to come.

The Company: Securitize is positioned as the leading institutional platform for real-world asset tokenization, targeting a $19 trillion TAM.

The Moat: Securitize is the only player licensed for regulated tokenized securities infrastructure in both the U.S. and the EU, among other key regulatory advantages.

The Partners: Backed by BlackRock, ARK, Morgan Stanley and other marquee investors, Securitize has captured 20%+ of the current RWA market.

The Political Tailwinds: The second Trump administration is aggressively pro-tokenization. SEC Chair Paul Atkins (confirmed April 2025) is a Securitize alum who sat on the company’s advisory board until early 2025. Additionally, Brandon Lutnick, son of Commerce Secretary Howard Lutnick, is the Chairman and CEO of the CEPT SPAC, aligning the company with the highest levels of the administration's "Crypto Capital of the World" agenda.

The Setup: A profitable fintech leader merging via SPAC, currently with a $10 NAV floor (trading near $11.30), offering a high-asymmetry “moonshot” on the future of global financial infrastructure. The SPAC Merger is likely to be completed in Q1 2026.

Inside fintech innovation, few ideas shine as brightly as tokenization – the blockchain-powered technology that transforms real-world assets into tradable digital securities. Tokenization is the inevitable evolution of capital markets. As BlackRock’s Larry Fink proclaimed in his 2025 investor letter, “Every asset – can be tokenized,” heralding a seismic shift that could swell the tokenized market from $20-30 billion today to a projected $4-5 trillion by 2030, per Citi analysts.

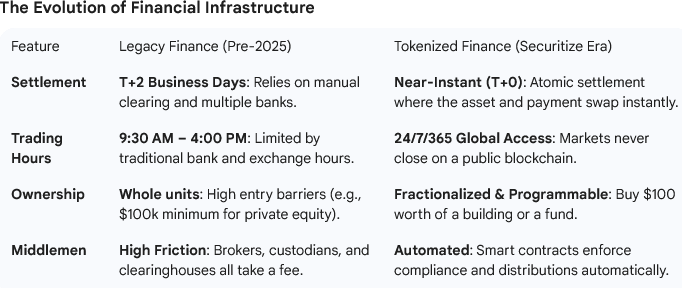

Tokenization is not a cryptocurrency fad; it is the modernization of the global financial ledger. The current financial system is crippled by legacy costs, antiquated infrastructure and friction points - inefficiencies that blockchain technology solves more cheaply and effectively. Some of the core pain points solved by tokenization include: Settlement delay (T+2 Friction), as tokenized securities settle near-instantly (T+0 or T+a few minutes); illiquidity and fragmentation, as tokenization allows for fractionalized ownership and 24/7 global trading; and cost of intermediation, as smart contracts eliminate numerous middlemen. Tokenization promises a world where ownership, value, and transactions move at the speed of the internet. See the evolution below:

Enter Securitize, the largest vertically integrated tokenization platform that has already tokenized over $4 billion in assets for Wall Street titans like BlackRock, Apollo, KKR, and VanEck.

With its pending SPAC merger via Cantor Equity Partners II (CEPT), valuing the firm at a modest $1.25 billion pre-money, Securitize isn’t just riding the tokenization wave – it’s engineering the tsunami. For investors, this is the possible moonshot with a safety net: a profitable disruptor backed by blue-chip heavyweights, turbocharged by Trump-era tailwinds, and currently offering a NAV redemption floor to limit downside.

Tokenization: The Unlocking Mechanism Wall Street Can’t Ignore

Securitize estimates a $19 trillion potential TAM for the tokenization of real-world assets under its opportunity set, specifically focusing on the migration of traditional financial instruments onto blockchain infrastructure. Even at $19 trillion, this would capture only a small slice of the $300 trillion or more in global financial assets outstanding.

Securitize frames this $19 trillion opportunity across three primary categories:

Equities: Digital representation of ownership in private and public companies.

Fixed Income: Tokenized bonds and debt instruments.

Alternative Assets: Private equity funds, venture capital, and real estate.

Tokenization is not a crypto sideshow; it looks like the next foundational infrastructure layer for finance, similar to what the internet was for information. Institutional adoption is now becoming real. Securitize has the infrastructure; these firms have the assets and capital.

In December 2025, Larry Fink, CEO of BlackRock, co-authored an op-ed in The Economist, drawing a direct parallel to the early internet’s explosive growth and tokenization. Fink writes, “If history is any guide, tokenization today is roughly where the internet was in 1996—when Amazon had sold just $16m-worth of books, and three of the rest of today’s ‘Magnificent Seven’ tech giants hadn’t even been founded. Tokenization could advance at the pace of the internet—faster than most expect, with enormous growth over the coming decades.” As I will explain later, BlackRock is both an investor and a customer of Securitize.

Another big proponent of the potential of tokenization is Vlad Tenev, CEO of Robinhood HOOD 0.00%↑ , who recently said, “Tokenization is like a freight train. It can’t be stopped, and eventually it’s going to eat the entire financial system.”

Grayscale (the world’s largest digital asset-focused investment platform) recently tweeted a summary from its research “Tokenized assets remain extremely small today—just 0.01% of global equity and bond markets. But with maturing blockchain infrastructure and clearer regulation, we see potential for ~1,000x growth of the amount of tokenized assets by 2030.”

Historical Parallel: Just as the internet evolved from fragmented dial-up experiments to a global economy driver, tokenization is poised to modernize outdated financial infrastructure. We can trace this evolution back to 1970’s SWIFT system (which cut settlement times from days to minutes) as a precursor, positioning blockchain ledgers as the next leap—enabling 24/7 instant settlements, fractional ownership, and programmable assets.

Securitize is Leading the Way for Tokenization

In this tokenization maze, Securitize is not merely a technology vendor; it is the largest vertically integrated, regulated platform that can operate across the entire lifecycle of a tokenized security. This integration allows RWA tokens to be issued, managed, and traded with the speed, transparency, and global accessibility of digital markets, while remaining fully compliant with securities regulations. By controlling the full lifecycle, Securitize ensures operational efficiency, investor trust, and recurring revenue streams, making it a full-stack infrastructure company for tokenized finance.

Securitize’s full regulatory stack includes: an SEC-Registered Transfer Agent; an SEC-Registered Broker-Dealer; an SEC-Regulated Alternative Trading System (ATS); and the world’s largest digital asset fund administrator (following its 2025 acquisition of MG Stover). As of late 2025, Securitize is the only company licensed for regulated tokenized securities infrastructure in both the USA and the European Union. This regulatory fortress is a competitive advantage.

Securitize is showing that tokenized securities can be built under current legal frameworks. That matters because regulatory and operational clarity is often cited as the main barrier for real-world asset tokenization. Securitize is solving these problems and as the regulatory excuse disappears, adoption is likely to follow which is exactly what is happening in real time right now.

Founded back in 2017 by the current CEO, Securitize is not a concept-stage startup. It is already the institutional leader in on-chain securities:

The largest tokenization platform in the U.S.

Backed by elite institutions (BlackRock, ARK, Morgan Stanley, etc.)

Operating with SEC-regulated entities: Broker-Dealer, Transfer Agent, ATS

Operating the world’s largest digital asset fund administrator

Managing over $4B of Assets Under Management (“AUM”) tokenized on-chain as of late 2025

Oversees $38 billion+ in assets under administration across 715+ funds

Recent partnerships include:

BlackRock, Apollo Global Management, Hamilton Lane, KKR, VanEck

This is infrastructure Wall Street is already using. Securitize has seven tokenized assets over $100 million in size, while the nearest competitor has two. Their compliance infrastructure allows institutional giants like BlackRock to plug directly into Securitize, which acts as the compliant gateway and makes it the heavyweight tokenization player offering fully regulatory compliant, cradle-to-grave tokenization.

Furthermore, Securitize is integrated with 16 DeFi protocols, 14 blockchains, and 12 prime brokers. Its ecosystem also includes three on-chain oracles for Web3 interoperability and six custodians. This expanding partner network continually reinforces the Company’s institutional moat.

On December 16, 2025, Securitize announced plans to launch the first fully compliant, on-chain trading platform for natively tokenized public stocks in Q1 2026. This initiative aims to bridge traditional stock markets with Web3 infrastructure, allowing investors to buy, sell, and hold real shares of public companies directly as blockchain tokens. Unlike derivatives or price-tracking tokens (for example, Robinhood’s 2025 tokenized U.S. stocks on Arbitrum, which are classified as derivatives), Securitize’s tokens are the actual regulated shares, eliminating counterparty risk and ensuring legal equivalence to traditional equity. Therefore, soon investors will trade real, regulated shares issued on-chain, where each token represents actual equity ownership in public companies. These tokens are recorded directly on the issuer’s official company shareholder ledger, ensuring legal recognition and full shareholder rights, such as dividends and proxy voting. While this appears to be a retail platform, my bet is the Securitize trading platform is not the core business model… It is a flywheel accelerator for the Company’s real money makers: issuance, its transfer agent engine, administration/management fees and platform infrastructure and servicing.

You need more proof Securitize is leading the way? Securitize powers BlackRock’s BUIDL fund, the world’s largest tokenized Treasury vehicle, which ballooned from $400 million to nearly $3 billion AUM in 18 months (and currently holds approximately a 40% market share in the tokenized treasury sector). Larry Fink doubled down on tokenization’s future in October 2025, declaring, “We’re at the beginning of the tokenization of all assets,” and likening it to “repotting” ETFs into digital formats for “enormous growth over the coming decades.”

BlackRock’s not alone: Securitize tokenization partnerships with Apollo, Hamilton Lane, and KKR and others have tokenized over $4 billion in funds alone, capturing an estimated 20%+ market share of the RWA market. For example, outside of BUIDL being the largest tokenized treasury fund, Securitize also has the largest tokenized institutional venture fund with Blockchain Capital, and the largest tokenized private credit fund with Apollo.

Additionally, while the tokenization explosion will have many winners, I believe the biggest winners in tokenization over the long term will not be the chains, the tokens or the retail trading platforms. I think the most value will accrue to the infrastructure companies sitting between assets and investors. In my eyes, the most value will accrue to whoever:

Brings assets on-chain

Manages compliance

Handles corporate actions

Integrates with institutions

That is just what Securitize does and its potential screams upside: Again, Citi sees up to $5 trillion in tokenized assets by this decade’s end; Securitize suggest it has a $19 trillion TAM across equities, fixed income, and alternatives. Securitize’s market leading position prepares it to siphon ongoing fees from this upcoming geyser, if tokenization takes off as expected. Revenue from issuance, management/compliance, and trading could multiply quickly as AUM scales, turning niche into necessity.

Financial Snapshot: From Startup to Profit Machine

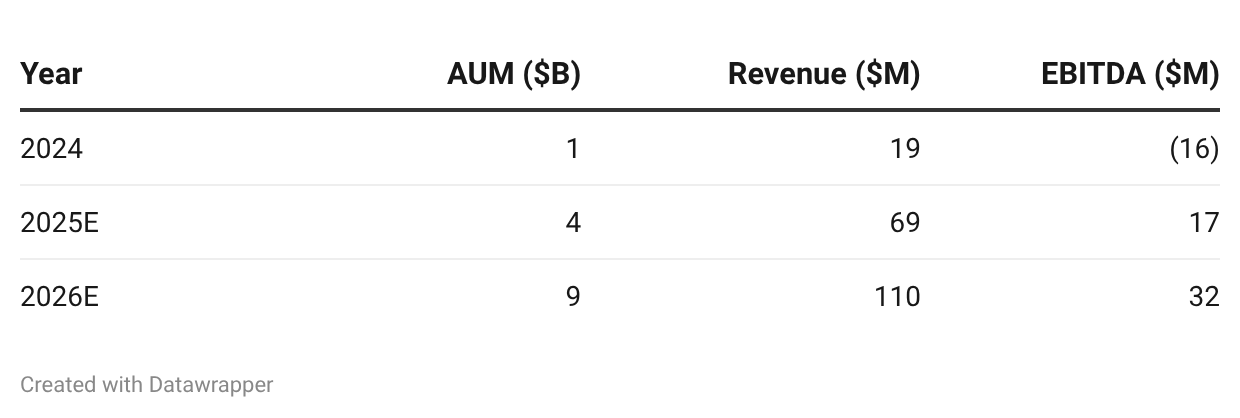

Unlike most emerging tech companies, Securitize isn’t burning cash – it’s printing it. Founded in 2017, the firm bootstrapped to profitability in recent quarters, fueled by BUIDL’s explosion and institutional mandates. Here’s the trajectory of approximate assets under management, revenue and EBITDA, per the Company’s Investor deck**:

Historical financials show massive revenue growth of around 9x in the last 16 months through Q2 2025 (per management), then pushing to a projected $110 million next year and doubling EBITDA to $32 million on almost 30% margins as the business model scales even at these revenue levels. Since Securitize’s compliance and transfer agent infrastructure are largely fixed-cost, every new dollar of AUM from giants like BlackRock drops straight to the bottom line.

2026 projections bake in conservative 2x AUM ramp – realistic given recent public statements from Securitize management, saying roughly $85 million of the projected $110 million in 2026 revenue is “already contracted or recurring”. Separately, management noted an upside case of $140 million in revenue in 2026 as a possible outcome.

What drives this growth:

Continued onboarding of new asset managers and institutional clients.

Expansion of tokenization use cases: not just funds, but tokenized treasuries, private credit/fixed income, and importantly, native public-equity tokenization (i.e., issuing publicly traded company stock on-chain).

Leveraging economies of scale: much of the infrastructure (transfer agent, servicing, ATS) should be largely fixed-cost; increased volume should flow heavily to EBITDA and increased margins.

At the $1.25B enterprise valuation for the SPAC (at $10/share), Securitize trades at between a 9 and 11 multiple 2026 EV/Revenue, not cheap in the absolute sense, but a potential steal versus fintech/emerging tech peers with far lower long-term growth and margin profiles and many of which have no or low revenue and no profitability. Profitability at Securitize is a differentiating factor versus its emerging tech peers and de-risks execution to some extent, funding organic expansion without dilution or a huge cash burn.

Note the current valuation is slightly higher than $10, trading around $11 and change, as I write this article over the holidays, so adjust accordingly.

Political Tailwinds: Atkins, Lutnick, and a Pro-Crypto White House

Securitize’s edge sharpens under the second Trump administration. New SEC Chair Paul Atkins (confirmed April 2025) isn’t just crypto-friendly; he’s a Securitize alum. Prior to inauguration, he was an advisory board member for Securitize until February 2025, held $250K-$500K in Securitize call options and championed tokenization via the Chamber of Digital Commerce’s Token Alliance. In his inaugural speech, he said the SEC could rebrand as the “Securities and Innovation Commission,” vowing “clear rules of the road” for token issuance and custody. Atkins’ “token taxonomy” framework – sorting digital assets into buckets could slash regulatory drag, fast-tracking Securitize’s public equity tokenization efforts. Further, the Digital Asset Market Clarity Act continues to advance through Congress, and at its completion, it will offer further regulatory framework for digital assets likely pushing digital assets even more into the mainstream.

The SPAC sponsor, Cantor Equity Partners II, is an affiliate of Cantor Fitzgerald, historically helmed by Commerce Secretary Howard Lutnick, who is Trump’s transition co-chair and a SPAC maestro. Lutnick’s White House perch signals policy alignment: lighter-touch regulations, pro-innovation funding, and tokenized infrastructure as national priorities. Howard Lutnick’s son is Chairman and CEO of the CEPT SPAC, if you needed even more proof of the direct connection to the White House Securitize might have. With Atkins at SEC and Lutnick at Commerce, Securitize’s merger likely sails smoother and has potential government in roads into pole position as the core, first mover infrastructure player in a regulated tokenization environment.

Rock-Solid SPAC Structure: Fully Committed PIPE, No Warrants, and Aligned “All Star” Insiders

SPACs have scars from 2021’s redemption bloodbaths, but Securitize’s setup screams discipline. The $225 million PIPE – led by Arche, ParaFi Capital, Borderless Capital, Hanwha Investment & Securities, and InterVest – is fully committed at $10/share in common stock. In a market wary of dilution, this SPAC is gold: no warrants or rights dilute post-merger, and adding CEPT’s $244 million trust provides a huge war chest of approximately $470 million (assuming minimal redemptions). Furthermore, the CEPT $225 million PIPE has been characterized by deal-side sources as the largest fully-committed common stock SPAC PIPE for an operating business in any industry since the peak SPAC era in 2021. That speaks volumes to me… real, big money at $10 a share behind Securitize. Since Securitize is already profitable the assumption is a good portion of this capital will go to acquisitions, which would further accelerate growth, and strengthen the market position of Securitize.

Securitize’s cap table reads like a who’s who of institutional and venture finance, along with some of the main players in crypto, and these insiders are locked in, with zero secondary sales or cash-outs: ARK Invest, BlackRock BLK 0.00%↑, Morgan Stanley MS 0.00%↑ , Circle CRCL 0.00%↑ , Ripple, Coinbase Ventures COIN 0.00%↑, Blockchain Capital, Hamilton Lane ($HLNE), Nomura ($NMR), Banco Santander ($SAN), Jump Crypto, and Tradeweb ($TW) all rolling 100% of their stakes, signaling conviction over extraction.

Another interesting aspect of the SPAC terms is the sponsor has agreed to potentially surrender and forfeit up to 30% of their Founder Shares (Class B shares) for no consideration based on the levels of redemptions from the trust. This is both Company and shareholder friendly (less dilution if the sponsor does not deliver the trust), but also puts pressure on the sponsor to “sell” the deal to Wall Street which would mean keeping/getting the pre-merger stock price above or hopefully well above $10 to avoid redemptions. In that regard, I expect extremely positive news flow as the merger date approaches.

Finally, to my understanding, there are lockups on resale for 180-days post-merger for the sponsors and insiders (with some limited carveouts if higher stock price hurdles are hit), ensuring investors of a limited share supply through the early despac phase. This isn’t set up as a pump-and-dump; it’s a better foundation for sustained outperformance.

De-risked, But It’s Not Without Risk — The Bear Case, and a Few Things That Could Go Wrong

Liquidity is still far from guaranteed. Many tokenized assets today remain illiquid; secondary markets are nascent. Academic research highlights slow trade volumes, limited active investors, regulatory gating, and fragmented custody as serious bottlenecks.

Regulation remains the wildcard. Tokenized securities must navigate a complex global patchwork of securities laws, custody frameworks, and institutional compliance demands. Any regulatory clampdown, delayed clarity, or jurisdictional friction could stall adoption.

Institutional inertia and legacy competition. Large incumbents — custodians, prime brokers, fund administrators — may build their own in‑house tokenization rails, undercutting the “full‑stack” value proposition that Securitize currently enjoys. Some of the legacy players (i.e. DTCC) are upgrading some of their institutional “plumbing” with blockchain/tokenization of entitlements, while Securitize is building a new, direct-ownership highway for investors to hold assets on-chain (native tokenization). At least for now, Securitize and the legacy players operate at different tiers of the financial ecosystem, solving fundamentally different problems from my perspective.

Additionally, “on-chain” tokenization competitors exist but none with the scale and full regulatory stack that Securitize currently enjoys.

While Securitize is tokenization/blockchain infrastructure and compliance focused it could get lumped into the crypto stock bucket if there is a selloff in those names along with Bitcoin, etc.

Finally, while a 10x revenue multiple is not expensive based on what Securitize could become, it is not cheap, if those growth forecasts do not materialize or broader adoption of tokenization slows.

These risks amplify potential stock volatility and are real risks for being an early leader in an emerging, unsettled market with an enormous TAM that many market participants will want a piece of… However, in my opinion they also offer asymmetric upside if tokenization becomes standardized infrastructure, and Securitize can capture significant market share.

The Asymmetric Bet Pre-Merger at Current Price: NAV Floor + Moonshot Upside

Risk-averse? CEPT’s SPAC trust at an estimated ~$10.30/share (plus or minus a few cents pro forma) and growing offers a redemption floor pre-merger vote “exit” if market sentiment sours or CEPT does not rip higher pre-merger, putting a hard floor on losses pre-merger. So, you have known, limited downside to see if pre-merger hype grows as we get closer to the closing, likely in Q1 2026, which I think will happen.

Future Upside? If tokenization hits Fink’s “internet pace”, Securitize could be a short, medium, and long-term multi-bagger opportunity. With BlackRock and other financial and crypto heavyweights behind it, Atkins’ advocacy, and Lutnick’s leverage with Trump, and tons of 2026 catalysts as tokenization becomes the next big theme in the markets in 2026 (as I think it will), the stock could rerate far higher on fundamentals, but frankly on hype and scarcity value as well. In those circumstances where scarcity “matters”, valuation seems to “not matter” for at least some period of time offering you a possible 2026 moonshot here:

Securitize will be the primary pure-play public tokenization company bridging TradFi and DeFi at scale when the SPAC merger completes. We saw Circle CRCL 0.00%↑ almost 10x when it first came public as it was the only pure play on stablecoins. Additionally, Figure Technology Solutions FIGR 0.00%↑, a recent fintech IPO that uses tokenization at scale, is up well over 100% from its recent IPO price.

Further, we have seen other SPAC stocks that are first to public market pure plays in emerging technologies “moon” both from excitement and scarcity value, as people want to express their views on upcoming market themes through these stock proxies. See Oklo Inc. OKLO 0.00%↑ , NuScale Power Corporation SMR 0.00%↑, IonQ, Inc. IONQ 0.00%↑ , Rigetti Computing, Inc. RGTI 0.00%↑ , D-Wave Quantum Inc. QBTS 0.00%↑ , etc., for recent examples of moonshots in “on theme” technologies like nuclear and in quantum computing that came through SPACs. These stocks ramped 5x to almost 20x at their heights from the $10 SPAC issuance price, and with far less of a current business, let alone profitability that Securitize already has today. So, I am saying you might win from a short-term investing perspective even if Securitize does not win long term because it is the main way to play the tokenization theme in the public markets for a period of time.

Why Securitize could become the “Digital Wall Street Backbone” of Tokenization

Securitize has the rare combination of:

Institutional validation

Regulatory legitimacy

Real revenue and usage

A clean path to hyper-scaling

This is the exact profile of companies that dominate next-generation financial infrastructure.

In 2000, smart investors invested in cloud‑infrastructure companies when the internet was still young. In 2026 we may look back and say we invested in the first “digital rails” for real‑world assets.

Securitize, with institutional backing, regulatory compliance, capital, and early‑mover advantage — is not a fringe crypto firm: it is a fintech infrastructure company with an opportunity to reshape global capital markets.

If tokenization is the future of finance — Securitize may well be the company building it.

The confluence of all the above and three major market forces: regulatory clarity, institutional adoption, and its move to the public markets transforms Securitize from a restricted venture bet into the primary institutional gateway for the tokenization theme in 2026.

Securitize is more than just a bet on tokenization; it is a bet on the inevitable rationalization of financial markets, a bet on what could be the foundation of global capital markets over the next decade, and the company that has successfully positioned itself today as the compliant, institutional gatekeeper to that $19+ trillion market of tomorrow. The early, disciplined focus on regulatory approval and institutional partnerships has created a moat, positioning Securitize for a period of explosive growth as the global financial system fully embraces the new digital ledger.

In summary, Securitize is the picks-and-shovels leader in real-world asset tokenization — a multi-trillion dollar TAM. This is not a “crypto hype” SPAC — it is a blue‑chip, institution‑friendly digital‑finance infrastructure play. If tokenization captures even a modest fraction (~5–10%) of global financial assets over the coming years, Securitize, as the leading infrastructure provider, could emerge as one of the more important fintech companies in the world, not just among crypto/defi players.

For investors who want regulated exposure to tokenization and the tokenization theme, Securitize represents what appears to be a clean entry as they attempt to “Tokenize the World”.

⚡ Final Verdict

Conviction: High

The Play: Accumulate CEPT 0.00%↑ now while it’s unknown to capture the Q1 merger momentum. You are protected by a ~$10.30 NAV safety net (pre-merger). If this becomes the primary proxy for the "Tokenization" theme, we may have a moonshot candidate on our hands.

To Do: Subscribe to this Substack now. I will be releasing specific price targets and regulatory updates as we get closer to the $SECZ ticker change.

*Link to Market Size Estimate - https://app.rwa.xyz/

**Link to Securitize Investor Deck Here - Investor Deck

Disclosures: I have a beneficial long position in the shares CEPT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it and I have no business relationship with any company whose stock is mentioned in this article. My articles are published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. I may sell or buy this security at anytime, before or after this publication.

Great write-up. I struggle to see what there is not to like here. Clean SPAC structure with no warrants/dilution, already profitable with real revenue growth, massive regulatory moat in US+EU, blue-chip partners like BlackRock rolling over, and positioned as the pure-play leader in a $19T+ TAM that's just starting to explode. Super excited to watch this story unfold as the merger closes and tokenization goes mainstream! I'm in for the ride!

Isn't it a bit odd to use the SPAC route instead of an IPO when spacs have such a bad reputation? It's like only junk gets listed via SPAC is the general view.